When time comes to sell property in Greece, being well-versed in the rules and regulations governing real estate transactions is not just a suggestion—it’s a necessity.

Greece, with its mesmerizing landscapes, deep-rooted history, and vibrant culture, has emerged as an enticing hub for property investors and those envisioning a Mediterranean dream home. Nevertheless, delving into the complexities of property sales in Greece demands a solid understanding of the legal and bureaucratic framework in place. From property taxes to documentation prerequisites and zoning laws, being acquainted with the rules is imperative for a seamless and successful property sale in this picturesque Mediterranean country.

Whether you’ve recently inherited a property or are contemplating the sale of a familial estate spanning generations, grasping the intricacies of this transaction is paramount.

In this piece, Greece lawyer John Tripidakis delves into the essential rules and guidelines crucial for anyone contemplating the sale of property in Greece.

Key Considerations:

Contrary to conveyancing practices in the U.S., Canada, Australia, and certain other countries, the process in Greece is not always straightforward, simple, fast, or cheap. Several factors contribute to this, including:

- The pending accomplishment of the new Land Registry Cadastral (“Ktimatologio”) and central computerization of properties.

- The existing old Titles’ Office system (“Ypothikofylakeion”) being a Registry by name, not by property.

- Scrutiny and securing of building zoning regulations, forest, archaeological, beachfront, or other administrative ownership issues, especially concerning land.

- The Greek State’s efforts to combat municipal/tax evasion and illegal building through conveyancing, necessitating a substantial number of certificates and documents from the seller.

- Challenges in opening a bank account for the deposit of sale proceeds, requiring extensive documentation from the seller’s country of origin.

This article aims to guide you through the requisite steps and documents for a property sale in Greece, highlighting potential “red flags.” The main professionals involved in this process are a lawyer, a tax accountant, and a civil engineer.

Navigating Legal Issues: Your lawyer, among other responsibilities, will:

- Conduct a thorough title search at the competent Land Registry (“Ypothikofylakeion”) and Land Registry Cadastral (“Ktimatologio”) for the property’s location.

- Apply for and procure all necessary documents and certificates from the relevant Registries.

- Rectify your Title in case of any defaults.

- Issue a Municipal tax clearance (“ΤΑΠ”) from the Municipality if applicable.

- Draft a Limited Power of Attorney for cases where you are not physically present in Greece for the sale.

- Represent you before authorities and corporations, executing the necessary tax statements.

- Oversee and coordinate the entire procedure, from drafting and reviewing the sale deed to depositing the money into your designated seller’s bank account.

Legal Counsel Considerations: When seeking legal assistance:

- Choose a fully trusted and specialized lawyer experienced in assisting Greeks of the Diaspora or Foreign Citizens.

- Insist that all communications, title searches, and progression reports be provided in writing.

- Reach a clear agreement on fees and out-of-pocket expenses, ensuring a detailed Cost Disclosure Agreement is provided before commencing work.

- Exercise caution regarding potential conflict of interest issues, especially in small and closed societies/cities in Greece where local professionals may be acquainted or related to your buyer.

Navigating Tax Accounting Issues: Your tax accountant will:

- Confirm your tax status/profile in Greece as a “resident of abroad” (“katoikos exoterikou”).

- Draft and file tax returns/statements, such as E-1, E-2, and E-9, with the Competent Tax Authority.

- Issue certificates related to property taxes and other tax-related matters.

- File a tax return after the sale of the property.

Tax Accounting Considerations: When engaging a tax accountant:

- If you are a tax resident abroad, appoint a local tax agent in Greece to facilitate communication with the Greek Tax Authority.

- Consider appointing a qualified, computer-savvy, and English-speaking tax accountant in Greece as your tax agent. This person can provide you with tax internet access codes and file tax returns on your behalf when due.

Navigating Engineering Issues: Your civil engineer will:

- Draft a recent topographic diagram (survey) with the GPS system, including current building regulations (applicable when land is involved).

- Procure a copy of the building permit and relevant diagrams from the Zone Planning Authority if the building has been constructed after March 14, 1983.

- Inspect the property and provide a certificate regarding the absence of illegal constructions or, if applicable, the legalization of such constructions against fines or funds (paravolo) as per law 4495/2017.

- Assist with forest, archaeological, beachfront, or other administrative ownership issues and clearances.

- Prepare the “electronic building identity” (“ΗΛΕΚΤΡΟΝΙΚΗ ΤΑΥΤΟΤΗΤΑ ΚΤΙΡΙΟΥ”) and file it at the State’s computer system.

Real Estate Appraisal and Agent Considerations:

- Consider hiring a certified appraiser and/or a trustworthy real estate agent to assess the current value of the property.

- Be cautious when dealing with local real estate agents, ensuring all agreements and transactions are approved by your lawyer before proceeding.

Fees and Expenses:

- The purchaser bears the conveyance tax and fees, while the seller covers costs related to professionals assisting in the sale.

Third-Party Assistance:

- Exercise caution when seeking assistance from non-professionally qualified relatives for legal, tax, or other professional work. Stick to competent professionals and ensure all agreements are in writing.

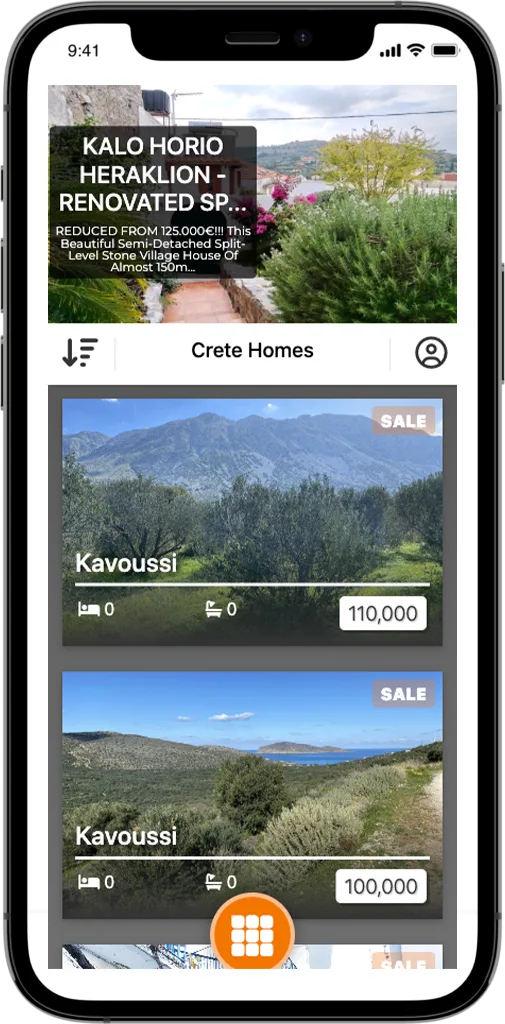

In conclusion, all these procedures can be implemented in Greece through a limited Power of Attorney to your trusted and competent Greek lawyer. Our office has assisted hundreds of clients in their sale/search of property in Crete, as well as hiring a trustworthy and thorough lawyer, so as for the procedure to be carried out smoothly without their physical presence in Greece being required.